What is the journal entry to record a foreign exchange transaction

By A Mystery Man Writer

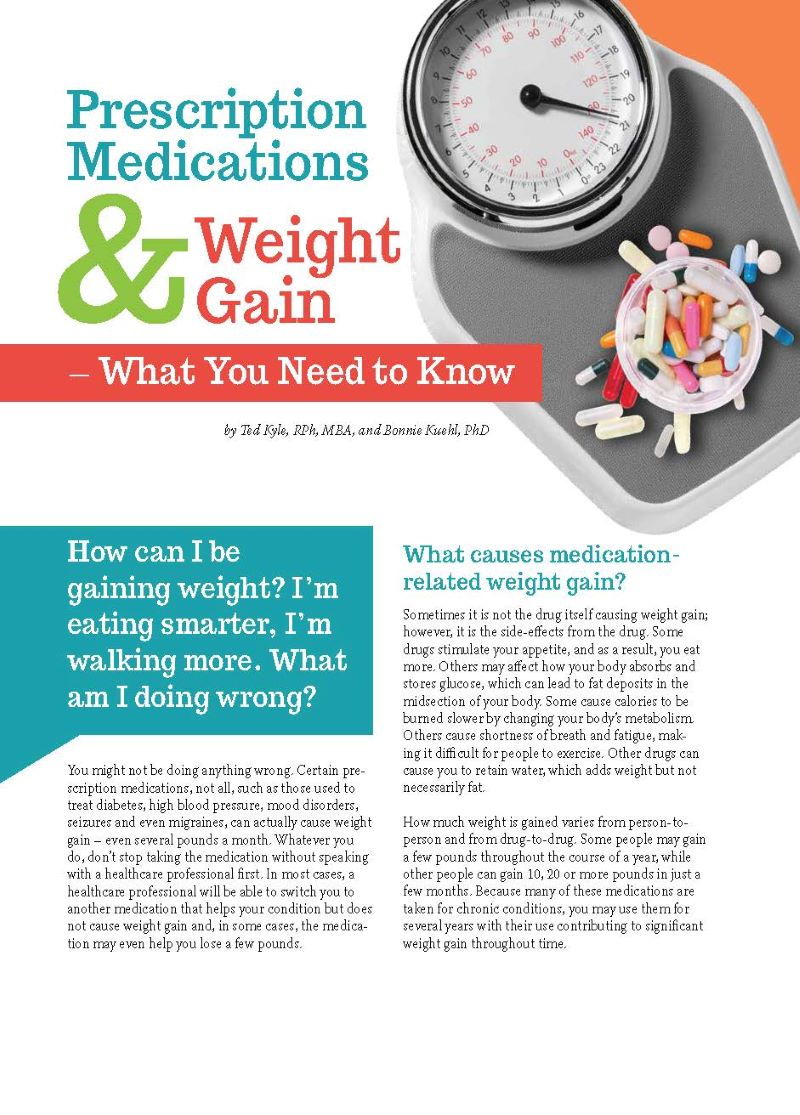

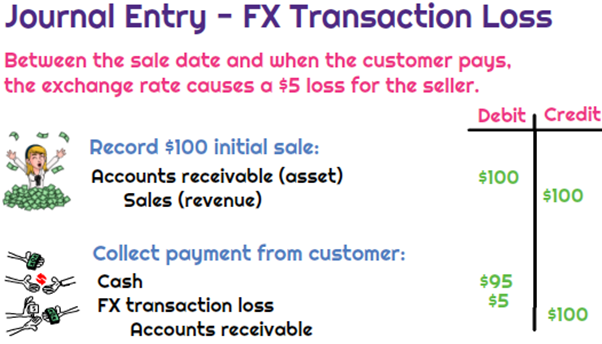

A foreign exchange transaction gain occurs when the transaction currency is different than the reporting currency for the company. On the initial transaction date, they would record the $100 sale with a debit to accounts receivable and a credit to revenue. However, 30 days later when the customer goes to pay using the current exchange

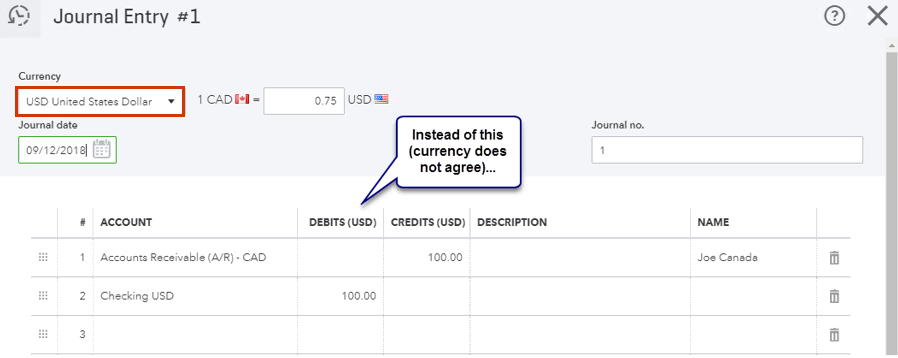

Solved: Setting a Spot Rate at EOY for USD values - MYOB Community

Multi-Currency: Journal Entry Error Message

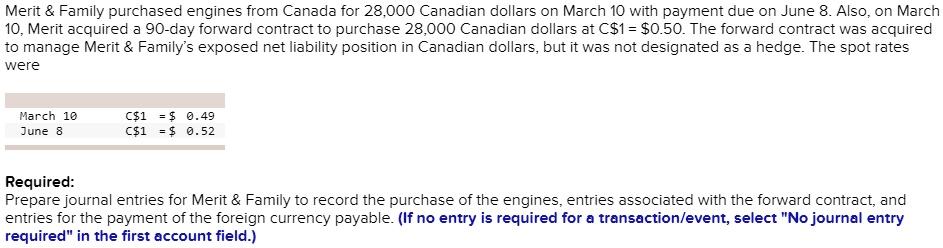

SOLVED: Record the foreign purchase of the engines. Record the entry for the 90-day forward exchange contract signed to receive Canadian dollars. Record the entry to revalue the foreign currency receivable to

PSA L&P - Journal Entries: How to record a deposit to or a withdrawal from a savings account, or an electronic funds transfer between bank accounts – ParishSoft

Hedges of Recognized Foreign Currency–Denominated Assets and Liabilities - The CPA Journal

Foreign currency invoices and bills – Help Center

SOLUTION: Important Questions on Foreign exchange and Hire purchase - Studypool

Simple Example for understanding Realized Forex Ga - SAP Community

Accounting for Bills of Exchange

What is the journal entry to record a foreign exchange transaction loss? - Universal CPA Review

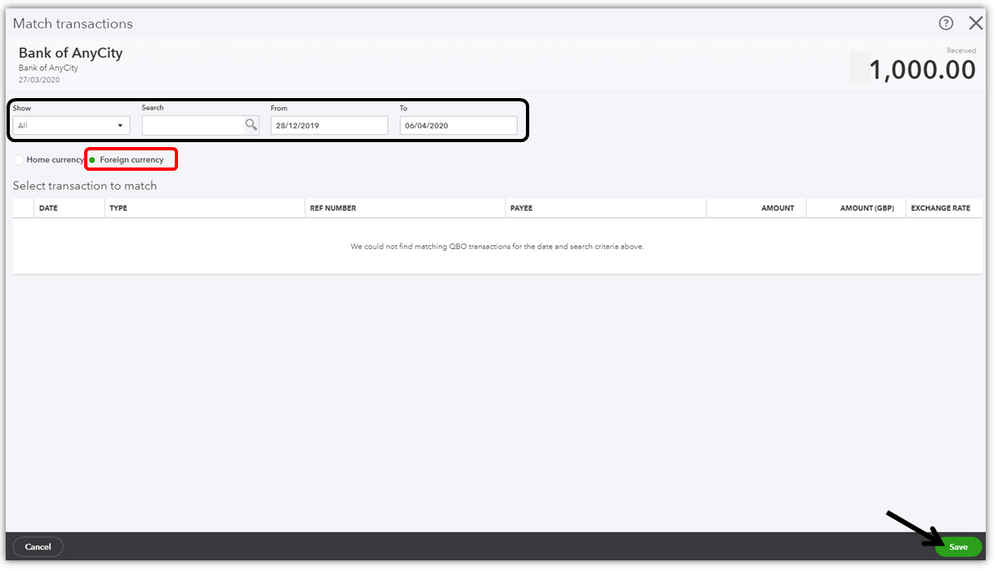

Record foreign currency payment against the invoice raised

Foreign Currency Transaction & their Journal Entry

Transactions - FCC AgExpert Community

Cumulative Translation Adjustment (CTA): The Ultimate Guide

Payment Entry

- Bra Girls Underwear Sets Teenager Cotton Bra Sets Floral Dot Lace

- Beyond Yoga Spacedye Slim Racerback Cropped Tank FRGRH Size XXS

- Mens Pajama Pants Wide Leg Sleep Pants Soft Comfy Long Pj Bottoms

- moda elegante mulher vestida estilo dos anos 1930 dos anos 1950. festa de vestido de moda

- Nike Sportswear Essential Women's High-Waisted Graphic Leggings