Tax Credits for Individuals and Families

By A Mystery Man Writer

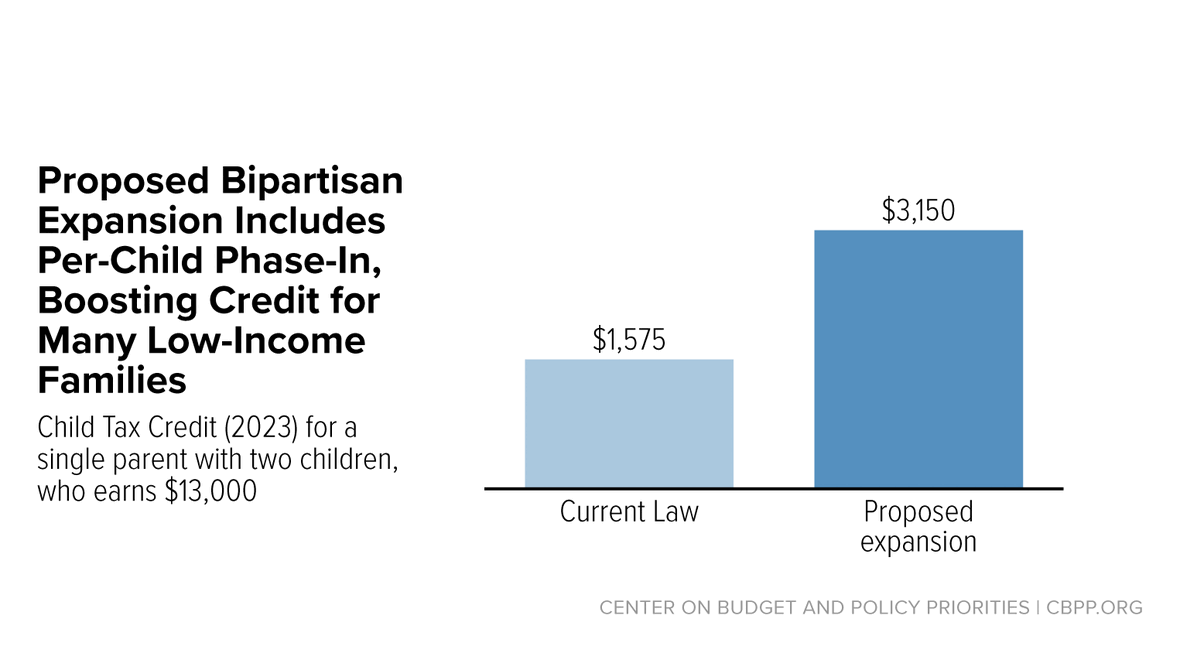

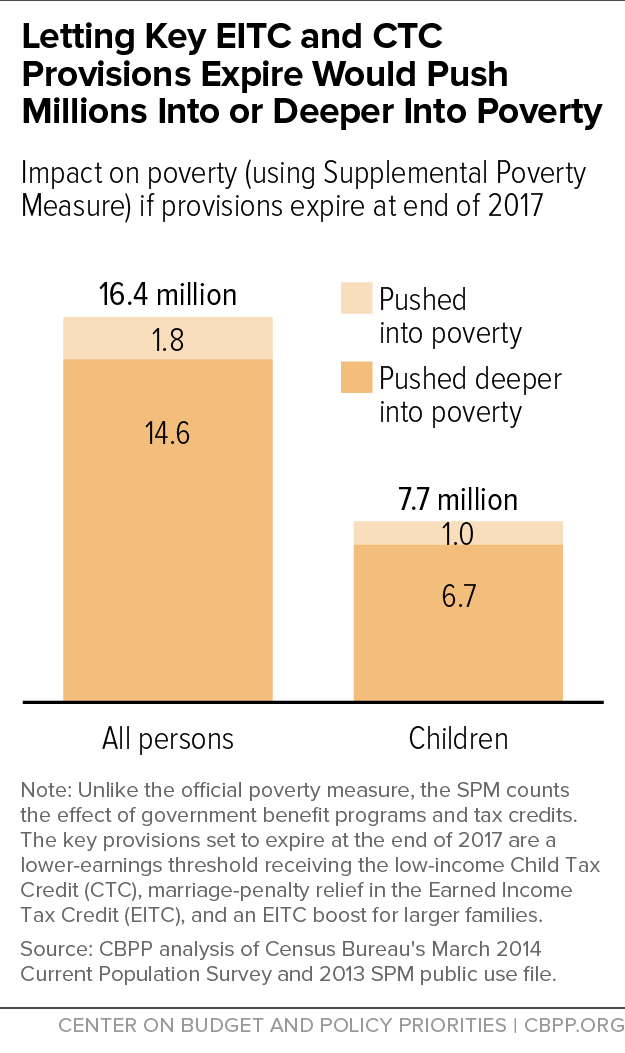

The Earned Income Tax Credit (EITC) encourages and rewards work for low- and moderate-income working people, while the Child Tax Credit helps families offset the cost of raising children.Together, the EITC and the low-income piece of the Child Tax Credit benefit 30 million households with low incomes, lifting 10 million people above the poverty line. We work to highlight the benefits of these credits and to protect and expand them to further reduce poverty.

Tips to deal with postpartum depression

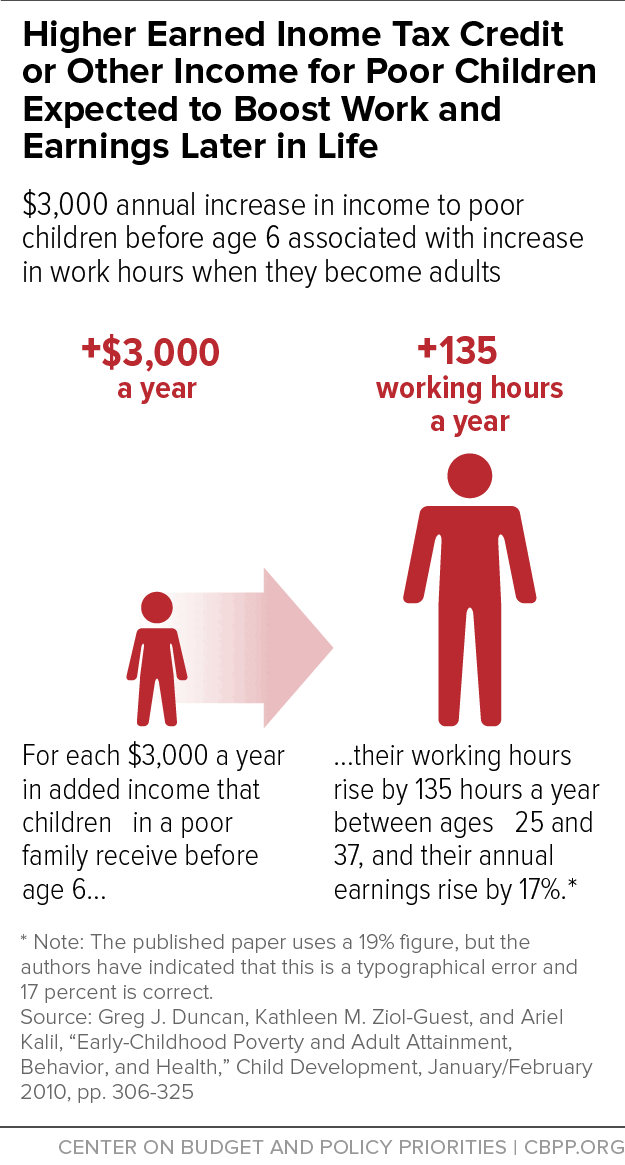

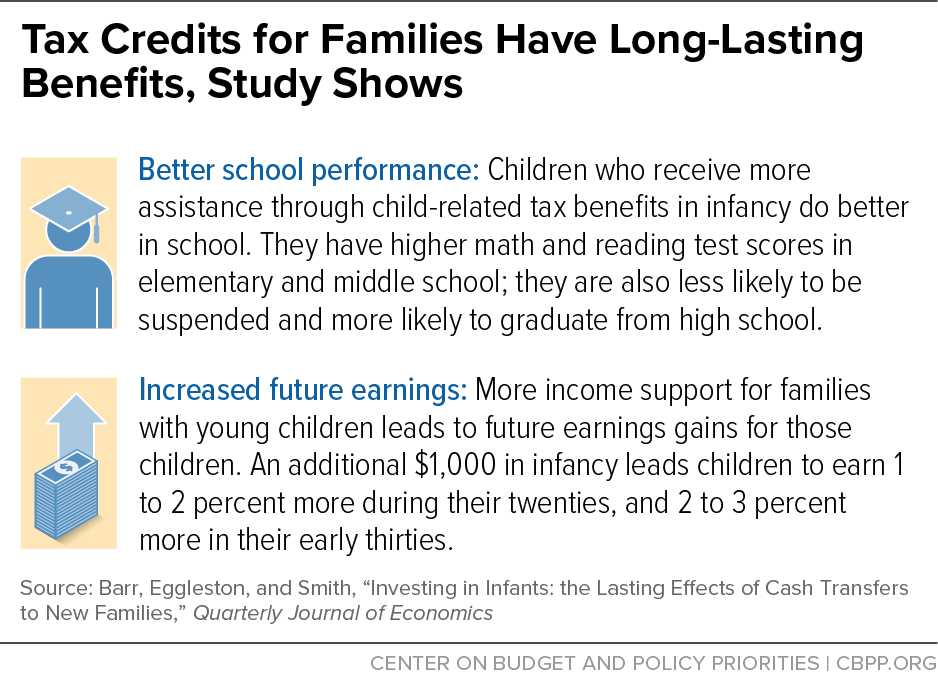

New Study Finds Income Support in Childhood Increases Future

What Are Tax Credits - FasterCapital

Federal Tax Credit - FasterCapital

Policymakers Can Help Millions of Working Families This

Solved 16) Which statement is true regarding the advanced

Tax Credits for Individuals and Families

The Benefits Of Allotment Communities For Individuals And Families

The speech from the throne

EITC: General Information and Fact Sheets

EITC and Child Tax Credit Promote Work, Reduce Poverty, and

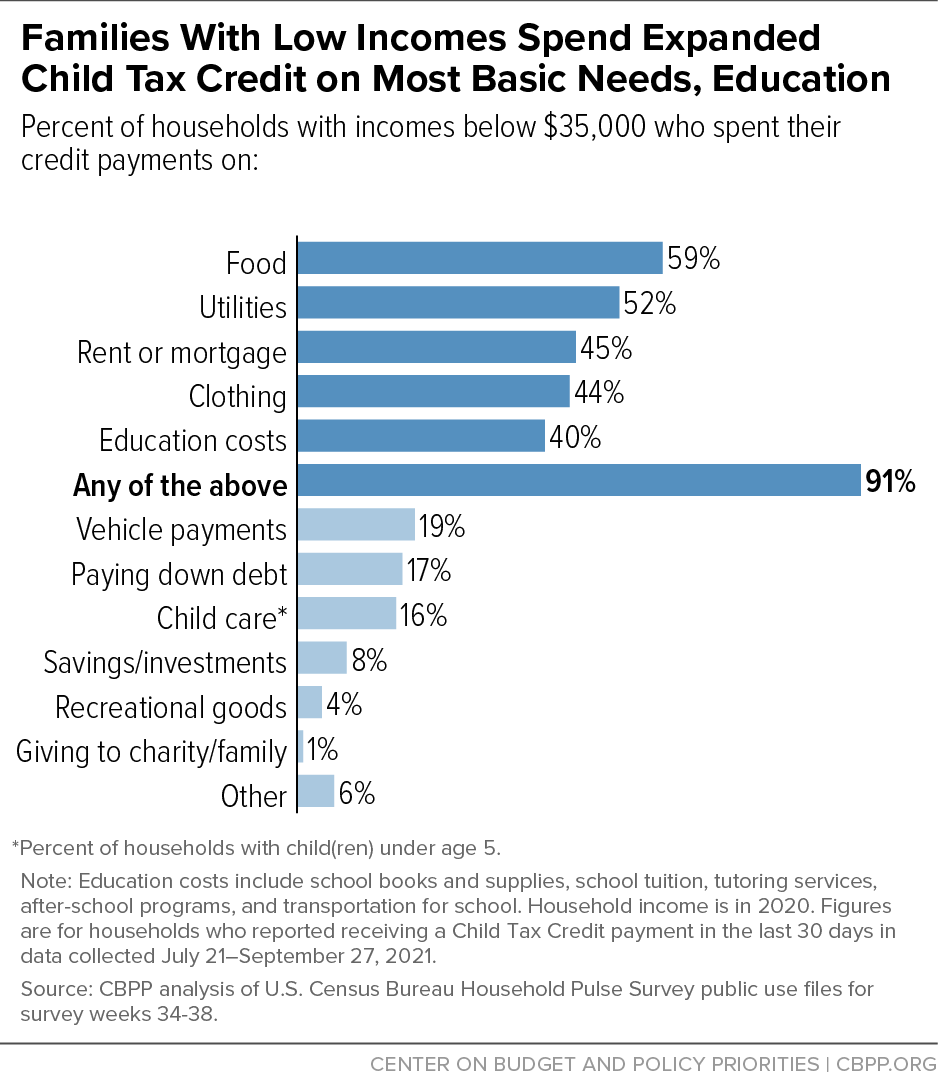

9 in 10 Families With Low Incomes Are Using Child Tax Credits to

New Study Finds Income Support in Childhood Increases Future