How to Trade the Nasdaq 100 Index Based on Risk Sentiment

By A Mystery Man Writer

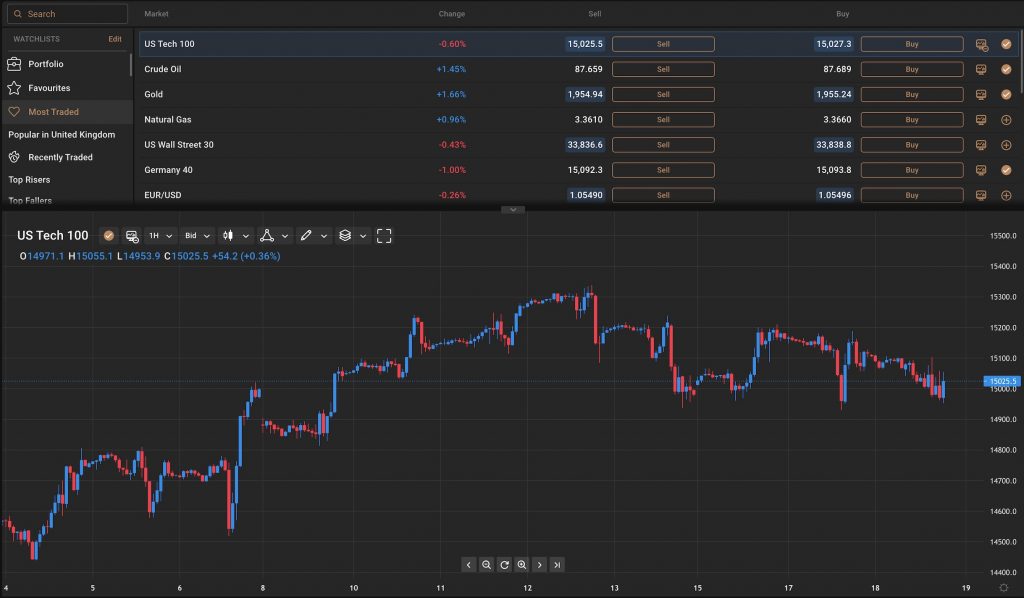

The Nasdaq 100 index is considered an asset that favours a risk-on investment. Stock markets are generally assets of risk and tend to attract demand when there is risk tolerance.

Nasdaq 100 Technical: Counter trend rebound at risk of exhaustion as key risk events loom - MarketPulseMarketPulse

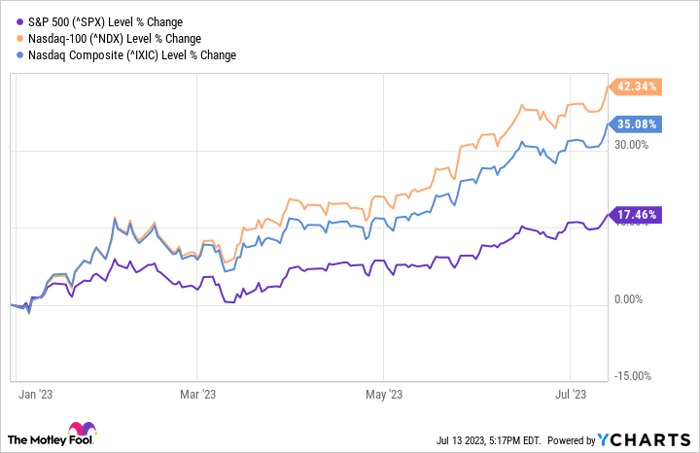

NASDAQ 100 Rally Continues. What's Next?

The Nasdaq-100 Is Undergoing a Special Rebalance. Here's How Investors Should Prepare.

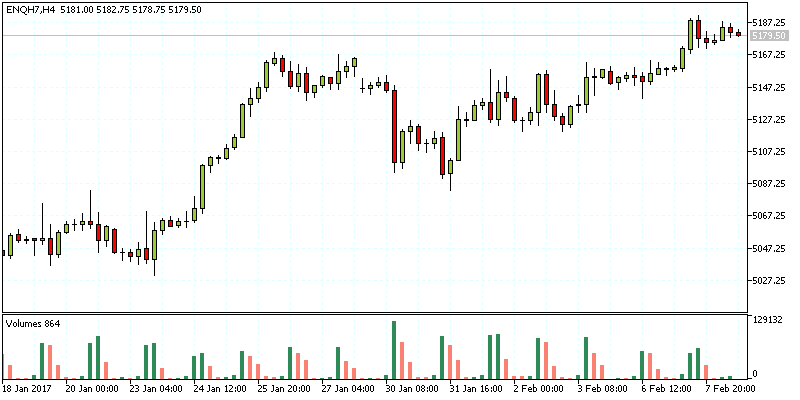

Nasdaq 100 Futures: 5 Key Facts to Know Before Trading

What Are Indices? A Guide To Index Trading For Beginners

Stock market today: Live updates

Trading With a Margin of Safety, Applied Materials Offers Value and Growth

The NASDAQ-100 Trading Approaches: Scalping, Intraday, and Swing Trading - Eightcap Labs

Exploring VXN: How Options Traders Utilize Volatility in the Nasdaq - FasterCapital

Why not just invest in Nasdaq 100? Passive investing in the Nasdaq 100 would have outperformed any dividend ETF in the last 5 years. Thoughts on this? : r/dividends

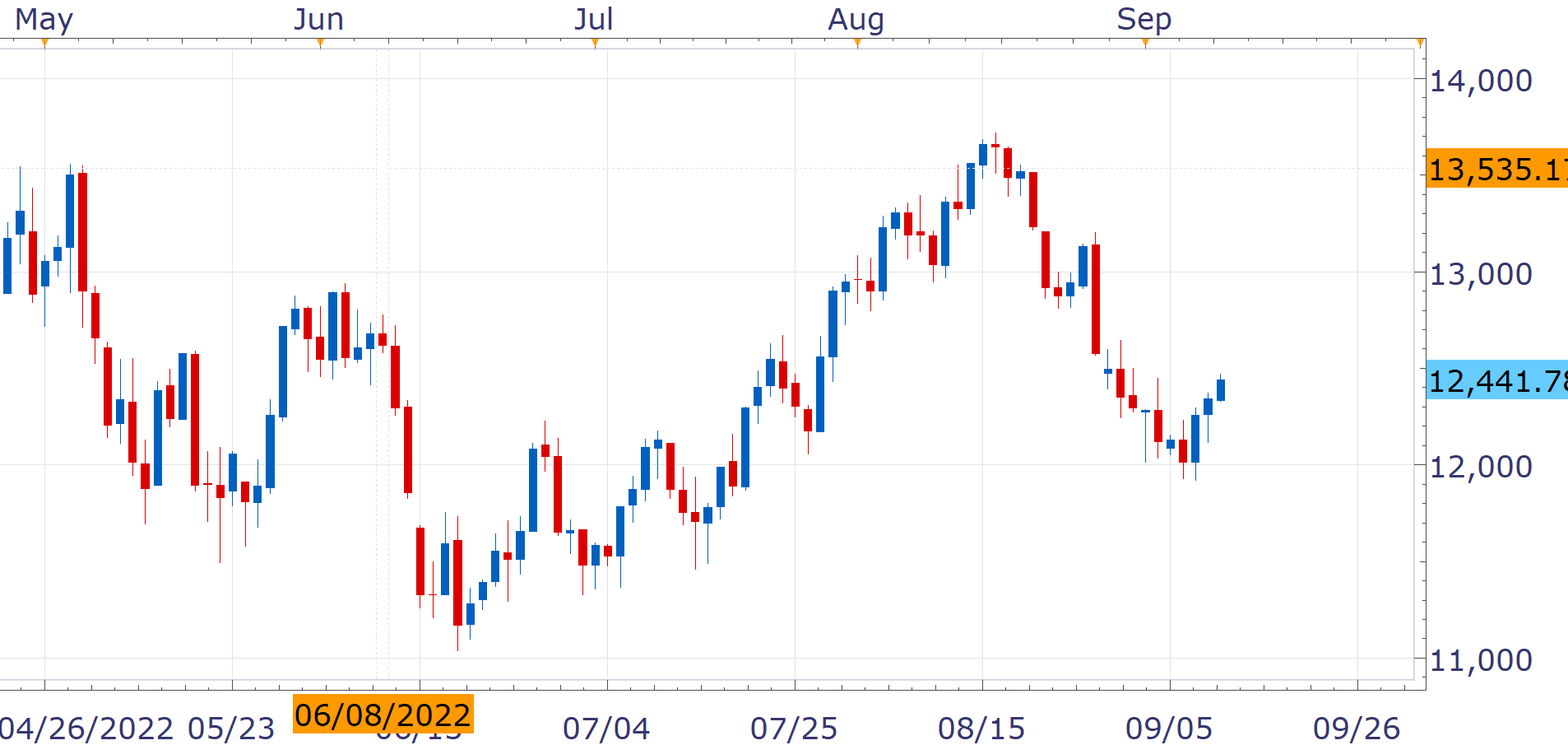

Nasdaq 100 Technical: Counter trend rebound at risk of exhaustion as key risk events loom - MarketPulseMarketPulse

The Best Market Sentiment Indicators you Should Know

- How to trade the NASDAQ 100: Everything you need to know

- The Nasdaq-100 ETF With 14% Distribution Yield

- Nasdaq 100 Forecast 2024 – NAS100 Technical Analysis

- Technical Levels to Watch in the Nasdaq-100 as 2024 Starts With the Rotation Trade

- Nasdaq 100 Hits Record High, Set For Best Annual Performance Since 1999 Tech Boom