Bull Call Spread: Definition, How it Works, Trading, and Benefits

By A Mystery Man Writer

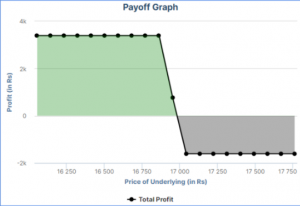

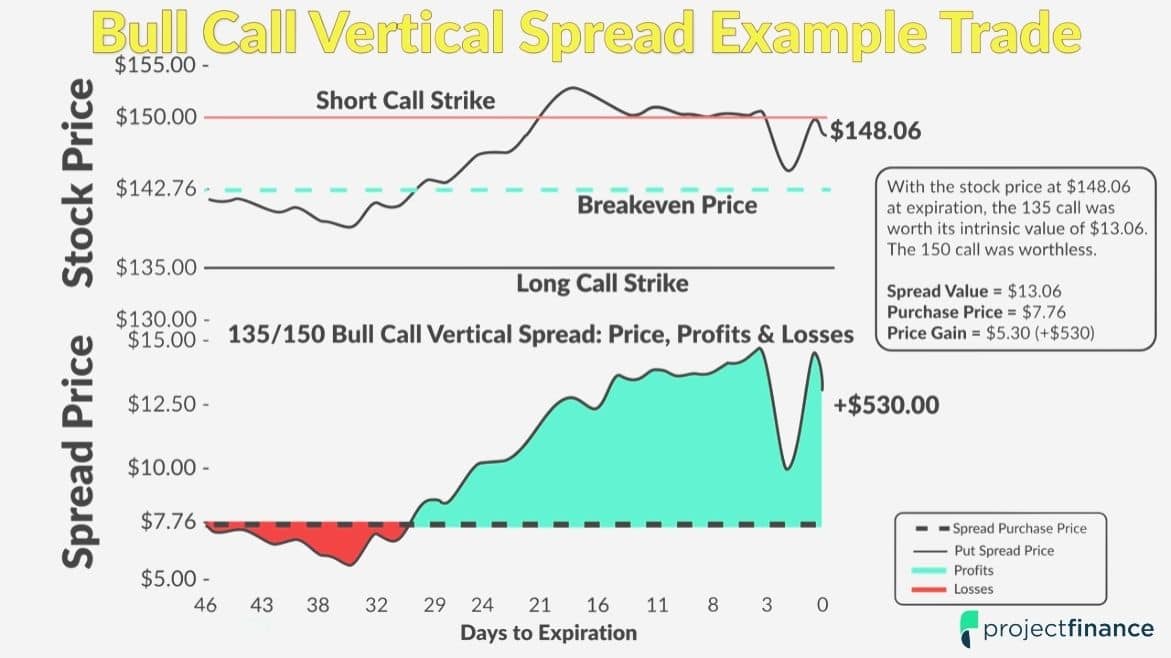

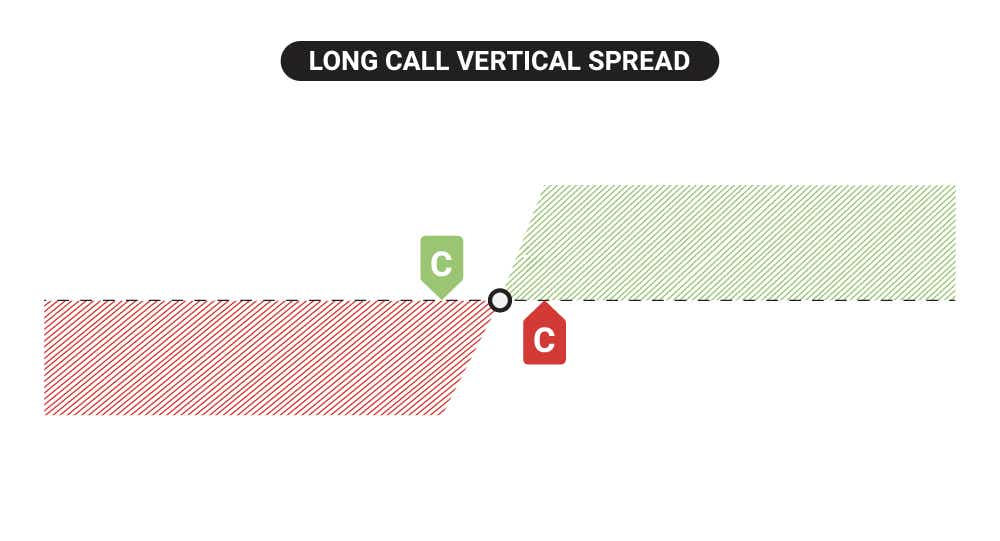

A bull call spread is an options trading strategy used when the trader expects a moderate rise in the price of the underlying asset. Bull call spread involves buying a call option with a lower strike price and selling a call option with a higher strike price.

What Is A Bull Call Spread?, Option Strategy Basics

Bear Call Spread: Definition, How it Works, Trading, and Advantages

Put Ratio Backspread: Definition, Advantage, Disadvantage & How It

School of Stocks - Bull Call Spread and Bear Call Spread

What is Diagonal Spread: Definition and How it Works?

Bull Call Spread Option: How It Works, Example, Strategies

Search Blog - Strike

Bull Call Spread – Varsity by Zerodha

Short (Naked) Call: Definition, How It Works, Importance, and Trading

4 Vertical Spread Options Strategies: Beginner Basics projectfinance

Debit Spread Explained: Definition, Example, vs. Credit Spreads

Bull Call Spread: Strategies Explained

Short Put Spread: Definition, How The Strategy Works, Examples

Call and Put Spreads Brilliant Math & Science Wiki

How to Trade Bull Put Spreads on thinkorswim®

- Under Armour Stryker WP Boots

- Dr. Fuji FJ-8400 Massage Chair – Wonder Massage Chairs

- Molly Gownie Maternity Delivery Labor Hospital Birthing Gown – Gownies™

- 70s High Waisted Bell Bottom Jeans Extra Small, 25 Vintage Dark Wash Denim Boho Flared Pants - Canada

- Akira - Kaneda 1/6 Scale Figure Project BM! - Spec Fiction Shop