Section 2(11) Income Tax: Block of Assets - Meaning & Concept

By A Mystery Man Writer

Section 2(11) of Income Tax defines 'Block of Assets' as a 'group of assets' in respect of which the same percentage of depreciation is to be applied

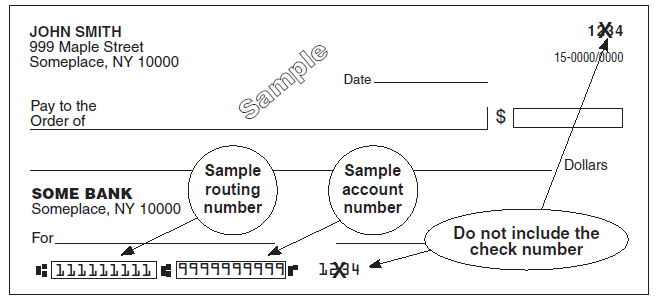

:max_bytes(150000):strip_icc()/1099-A-0151e1f82f624920b802b26d693d47f6.jpg)

Form 1099-A: Acquisition or Abandonment of Secured Property

2023-2024 Tax Brackets and Federal Income Tax Rates - NerdWallet

Detailed Guide on Capital Gains Taxation, Section 45 to Section 55A

Free Tax Calculators & Money Saving Tools 2023-2024

What Is a Section 121 Exclusion? Definition, Example and Basics

Good Intentions, Perverse Outcomes: The Impact of Impact Investing!

Instructions for Form IT-203

Publication 946 (2023), How To Depreciate Property

Rental Income Taxes

Depreciation of Business Assets - TurboTax Tax Tips & Videos

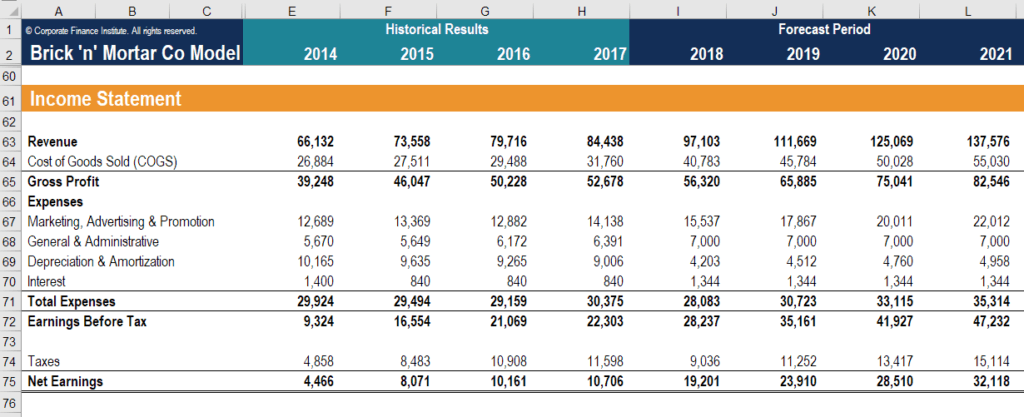

Financial Forecasting Guide - Learn to Forecast Revenues, Expenses

Financial Goals - Meaning, Examples, Types

:max_bytes(150000):strip_icc()/TermDefinitions_Fixed_Asset_Turnover_Ratio_-d269a3bf50b040dcb50552ac0ac79e4f.jpg)

Fixed Asset Turnover Ratio Explained With Examples

- Kristie Sports Bra (Smoked Blue)

- Women Lace Embroidery Underwear Sexy Deep V Push Up Bra and Panty Set Summer Mustard Color Lingerie Adjustable Strap Brassiere

- sexy woman in black underwear near handsome shirtless man Stock

- Digital Camo Yoga Capri Leggings – milfies

- Odd Sox, Reese's Peanut Butter Cups, Men's Fun Boxer Brief Underwear, Small at Men's Clothing store