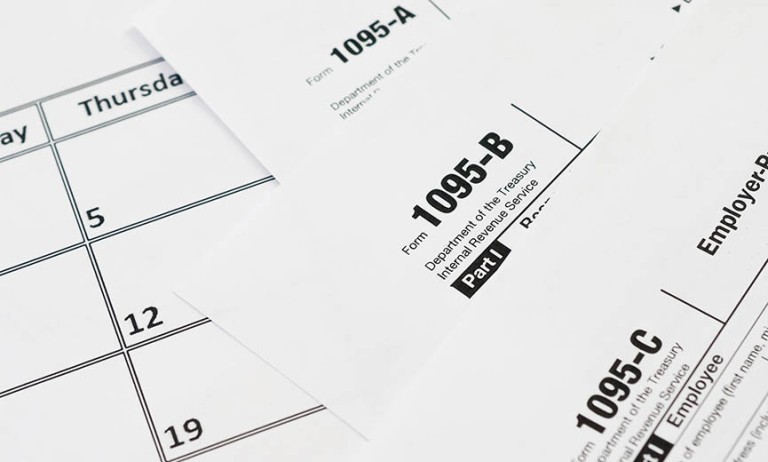

1095 Forms: 1095-a vs. 1095-b vs. 1095-c

By A Mystery Man Writer

Employers may become overwhelmed by health insurance paperwork and reporting responsibilities. Under the Affordable Care Act (ACA), the IRS requires all applicable employers and qualified health plan providers to report information about their health plans and health coverage enrollment using tax Forms 1095 A, B, and C. However, there are different requirements for each of these documents.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095-C: Definition, Uses, Tax Filing Requirements

IRS Form 1095-a 1095-B and 1095-C Blank Lies on Empty Calendar Page Stock Image - Image of budget, currency: 161092817

A Guide to Forms 1095 & 1098 and Nonresident Tax Returns

Forms 1095-C and 1095-B Furnishing Deadline to Employees Delayed - HR Works

The SECURE Act and Profit-Sharing Plans

1095-B vs 1095-C: What's The Difference? – Forbes Advisor

Form 1099-K: New Threshold and Business Tax Implications

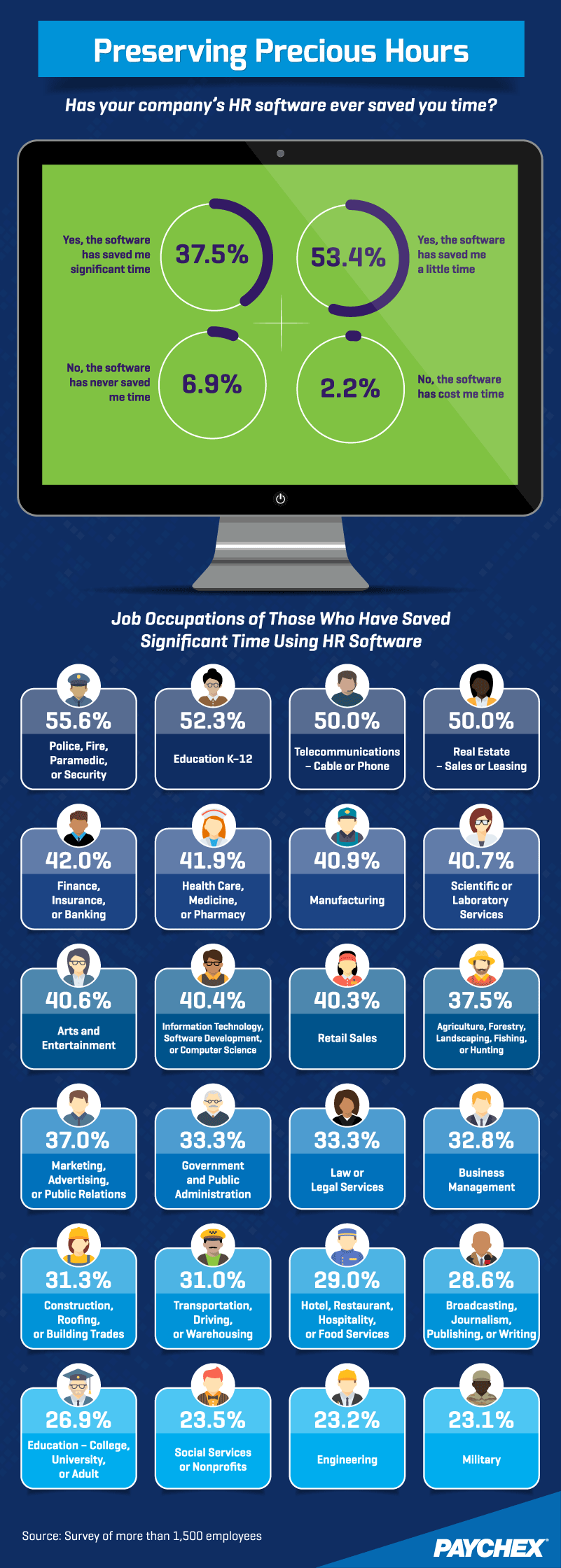

There's an App for That: HR Goes High-Tech

Annual Health Care Coverage Statements

What does a 1095-C delay mean for 1040 filings? - Integrity Data

- How is the B21 bomber different from the B2? They look the same. - Quora

- B16.47 Series A vs Series B: What's The Difference? - Texas Flange

- Mini USB vs. Micro USB: What�s the Difference?

- What's the Difference: Hepatitis A vs Hepatitis B - Hepatitis B

- Difference between b and v pronunciation - Mingle-ish